Flavoured/mixed lager and non-alcoholic beer, lead growth

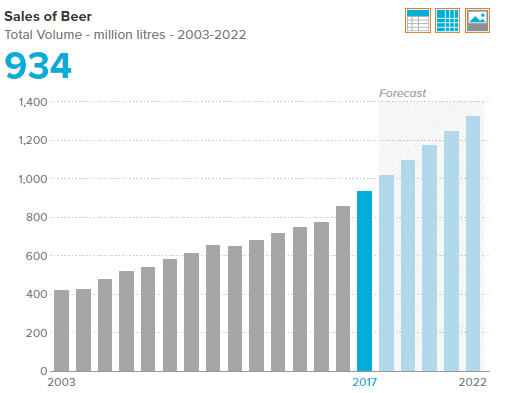

Whilst beer saw strong total volume growth in 2017, flavoured/mixed lager and non-alcoholic beer, two smaller less traditional categories within beer, saw much stronger increases, and were the most dynamic in beer. Apart from their small size, their rapid growth can be explained by the greater variety of imported brands and the appearance of new flavours in the case of flavoured/mixed lager, and by the tightening of restrictions and punishments for driving under the influence of alcohol in the case of non-alcoholic beer.

Imported lager becomes more important

In 2017, imported lager increased strongly in total volume terms; seeing a much higher increase than that registered by domestic lager. During the last decade, the importance of imported beer within lager increased very rapidly; its share increased by 25 percentage points in total volume terms between 2009 and 2017. The main reason for this growth was the sophistication of national consumers, who in the last decade began to familiarise themselves with imported beers. This process was accelerated by the earthquake of 2010, when the most important companies, such as Cervecerías Chile and Cía Cervecerías Unidas, were forced to import beer after suffering significant damage to their plants. The main distributors of beer responded to this trend by expanding the range of imported brands available in the Chilean market, especially artisanal products.

CLICK FOR DETAILS AND REGISTER TO THE CHILE TRADE MISSION

Craft beer gains visibility

Chile is a country in which craft beer has developed rapidly. The number of microbreweries increased from 160 in 2011 to more than 300 in 2017, and the share of craft beer increased within total volume sales of beer. There are several drivers behind the rapid growth of this type of beer in the country. First, there is the on-trade channel, as the number of places offering craft beer on their menus did not stop growing in recent years. Second is the large distributors, such as Cía Cervecerías Unidas and Comercial Peumo, which have included the most important national craft beer brands within their portfolios; taking charge of their distribution and giving them a presence in both modern and traditional channels at national level. Finally, there are growing number of beer festivals and related events, which gained popularity in recent years and have become a showcase for microbreweries.

Look out for more updates on this market.